What will happen to crypto when USDT collapses?

Intro

The cryptocurrency markets are (in)famous for volatility. While the volatility is attractive for traders, it hinders the potential of cryptocurrencies from becoming a settlement unit, thus making them differ drastically from traditional fiat currencies. The cryptocurrency “industry” has responded by introducing a solution to the market — a stablecoin. A token which is a digital representation of fiat.

Stablecoins are kind of like the bank accounts of the crypto world, designed to serve as a store of value investors can turn to in times of market volatility.

Tether is the first truly successful and established stablecoin. It can also be argued that it is the most universally accepted crypto-asset, far outdoing the usual suspects — Bitcoin and Ethereum. Nothing really comes close to the ubiquity of USDT. There is almost no cryptocurrency exchange that does not list Tether among its main market pairs. Tether is not only listed on all exchanges, but it is also the dominant market by volume across the entire crypto scene.

Tether is a blockchain token, available on multiple blockchains, which is redeemable for USD in a 1:1 ratio. At least that’s the claim, and how Tether keeps the peg is beyond the scope of this article. What is important is that cryptocurrency scene accepts USDT at face value and treats it as dollar equivalent.

Tether was first launched in late 2014, as a token on Bitcoin (using Omni protocol). Since, Tether had issued tokens on Ethereum, Tron, and some other blockchain networks.

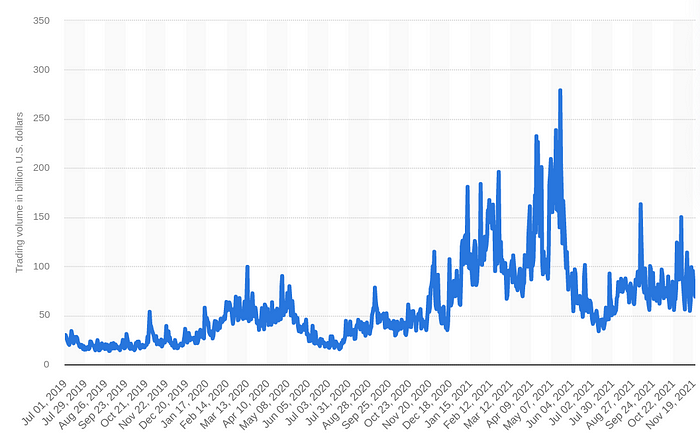

As indicated in the graph below, USDT began to gain serious traction near the beginning of the 2017 ICO boom and subsequent crypto bubble.

Tether was a powerhouse in terms of influence on the cryptocurrency scene in general already before the great crypto bust of 2018/2019. Things speed up after the bust and into 2020/2021 (the beginning of the new bubble) and Tether rises to dominance on the scene. In 2021 and 2022 USDT daily volume commonly exceeds $100B as Tether has established itself as the base token of the entire crypto market.

Per data provided by coinpaprika.com, at the time of writing Tether sports marketcap of $72,382,520,395 and is #3 cryptocurrency by marketcap, just behind Ethereum. At the time of writing, Tether is #1 cryptocurrency by daily volume, outpacing Bitcoin and Ethereum combined.

Tether is crypto, crypto is Tether.

If cryptocurrency was an engine, Tether is 6/10 of it’s pistons.

The Tether carries 6 of 10 top Bitcoin markets by volume, 7/10 for Ethereum, 6/10 for Cardano, 6/10 for Ripple, and so on. It’s basically the lube to keep the “top CMC” party going for years now.

Market makers (the guys who make markets liquid) of crypto have proven that they have received extraordinary amounts of USDT from Tether Inc., which shows how important is Tether for crypto liquidity.

Remarkably, crypto market markers have consumed the overwhelming majority of all USDT ever issued (the chart bellow). Besides market markers, it seems that if you’re big enough actor in crypto you can get a loan from Tether. Like Celsius ponzi founder recently did. “The investigation found that Tether had loaned billions of dollars to crypto companies using bitcoin as collateral.” Reported interest rate is 5–6%. Does this make Tether the central bank of crypto?

Based on personal multi-year insight into cryptocurrency markets and data published on protos.com I must conclude that Tether is what keeps crypto liquid and tradable. When Tether bites the dust, liquidity will be gone, and if liquidity is gone, the trader party is over, if the trader party is over — crypto exchanges are bust.

If crypto was a country, Tether would be it’s official currency. A legal tender.

Believe it or not, crypto has an internal economy, a self-referencing economy. The crypto economy is mostly about services that act within the wider ecosystem and serve the ecosystem itself. Exchanges, being hot spots of crypto activity take listing fees in USDT, project advisors take USDT payments, developer studios and freelancers take USDT as payment, money laundering services use USDT, and various crypto services like payment providers will also take USDT as payment for their services. There is nothing that can instantly replace USDT at moment’s notice.

The crypto economy heavily depends on the “number goes up” mentality, and it is not hard to imagine how will collapse of Tether affect the number. The collapse of Tether will put a wrench into the crypto economy, basically ending it or at least pausing it for a prolonged period. Exchanges and their fat stacks of USDT tokens will become worthless, investors, traders, and freelancers of crypto will not be able to cash in their “offshore” bank accounts, and investors will get shell shocked and stop bringing fresh money. It all just stops.

What will happen to the number?

I guess the majority of readers are waiting for this paragraph, what about the number? The number goes up, right? Yes, the number goes up. But not the number you hope for.

Imagine if everything in crypto traded only through an AMM contract, a single pool on uniswap for the entire crypto market. On the buy-side of the pool, it’s 90% USDT and like 10% of real money. On the sell-side it’s all crypto, ever. Pull Tether out and 90% of liquidity goes out the window, specifically near-spread liquidity which is the most important for day traders.

Now, imagine, what happens if USDT becomes zero? What happens to the AMM pool now? How will the price move?

Crypto will spiral into an unprecedented liquidity crisis, the kind for the history books and economists to study for decades to come. The price of popular assets will instantly shoot up to hundreds of thousands or millions (of Tether) as people rush to actual coins to flee from exchanges. The question is are the exchanges solvent and can they withstand the “bank run” of such proportions. But that is a topic for another day. Actual DeFi pools which trade USDT to other stablecoins will quickly get drained of other, more trusted stablecoins. Just recently, in May of 2022, we had a preview of the situation. Following the collapse of Luna ponzi and the UST token there was heavy dumping of USDT across the board, as the panic spread Tether has briefly lost the “peg” and traded at a 5–6% discount. There was a spike of popular stablecoins on Binance for example, as well as market buying of Bitcoin as people have tried to flee USDT.

All USDT-fiat markets would get dumped and get completely drained of buy-side liquidity, for a fraction of a (real) dollar you will probably be able to obtain large amounts of USDT and then use this cheap USDT to drain the sell-side liquidity of crypto market. Imagine paying $10 for a bitcoin if you’re lucky enough, by catching USDT at near zero and catching some bot order on the USDT-BTC market.

The liquidity pools will end up with billions of Tether in hours until there’s nothing else on the sell-side.

What about you, the coin holder? You will try to panic dump your stacks of coins as the market crashes at a dizzying pace. You will try to sell coins but nobody is there to take them, liquidity is gone. Even a minor sale of say 10 bitcoins could take the price down 25% or more, depending on the market activity at the given moment. Emperor is naked, it will become obvious in minutes that the crypto marketcap is unsustainable and not real. The best you can do is to sell your coins for millions of USDT — but why would you do that?

There will be a scramble to collect any real money on buy orders across all exchanges, it probably won’t take but a few days before the discount on crypto is 90% or more. Market makers who provide liquidity in real money will take heavy losses unless they unplug their systems and remove orders extremely quickly. Arbitrage bots stuck in their loops will also end up with bags of Tether and take serious losses before they are unplugged. Crypto funds will use their ties and connections with exchange operators to exit before the common users. Ethereum gas fees will spike up immensely as people rush to arbitrage the DeFi liquidity pools or exit to stablecoins.

The crisis will spill over to the rest of stablecoins, most will trade well under a dollar and some, which rely on algorithms and/or a basket of cryptocurrencies to keep the peg will simply collapse like a house of cards in a hurricane.

What will do the most damage of course is the “theater on fire” effect. Crypto has been growing for years and years and the exit doors did not get bigger, they’ve stayed roughly the same while the theater got much much larger. It’s simply impossible for participants in the crypto market to cash out without a 99.99% discount. The theater will go up in flames and people will rush over people to get out.

Aftermath

I believe the aftermath has already started. There are already reports that there is a steady flight from USDT to more trusted stablecoins like USDC.

Since May 9, more than 130 large wallets increased their USDC balance by at least $1 million and decreased their Tether balance by at least $1 million. This is perfectly reasonable, smart money is seeing the “writing on the wall” and is not risking it. There is simply too much money at stake.

It is expected that USDC will become a replacement for USDT on a global scale, however, USDC is far more regulated than USDT and I do not see this fact as being accepted by crypto cartels. USDC can freeze any account at the request of law enforcement, which they have done several times already. [2] That does not play well with bribes, money laundering, theft and market manipulation, and other illegal acts often associated with Tether. What I’m saying is that some actors simply can not move to USDC as their business model depends on having access to a completely unregulated digital USD. Thus, it is impossible to imagine what will go down and what will replace USDT.

I am not writing about this to instigate a panic or to influence anyone or anything, I am writing about this to point out how Tether is a systemic risk to the entire crypto scene. A kill switch. It is such a risk that it will heavily influence even assets which are not intertwined with Tether — such as Peercoin. For assets that rely on Tether heavily (honestly anything “hot” in the last bubble), it will definitely be a game over.

I understand how did things end up the way they did, complete lack of regulation and thus consequences have led crypto to evolve into this monstrosity it is today. Mix that up with unprecedented levels of greed and corruption which is systemic in crypto for years — you get a perfect recipe for disaster.

In the collapse of Tether, I see the chance to purge what is wrong and start over. With that said, the reputation of crypto will not recover for years and governments will use the shock to place heavy restrictions on the scene.

This is probably when CBDCs take over. Crypto will change immensely.